The technology

Blockchain is a distributed database or ledger that stores records of transactions in blocks. Each new block has a unique encrypted fingerprint and is linked to the previous block. This ensures the blockchain cannot be changed retrospectively. As new blocks are written, the updated blockchain is continually replicated across other copies. The process also ensures that conflicts (where more than one block is created at the same time) do not arise across the multiple copies of the ledger.

The potential

Netscape co-founder Marc Andreessen said blockchain “gives us, for the first time, a way for one internet user to transfer a unique piece of digital property to another internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. The consequences of this breakthrough are hard to overstate.”

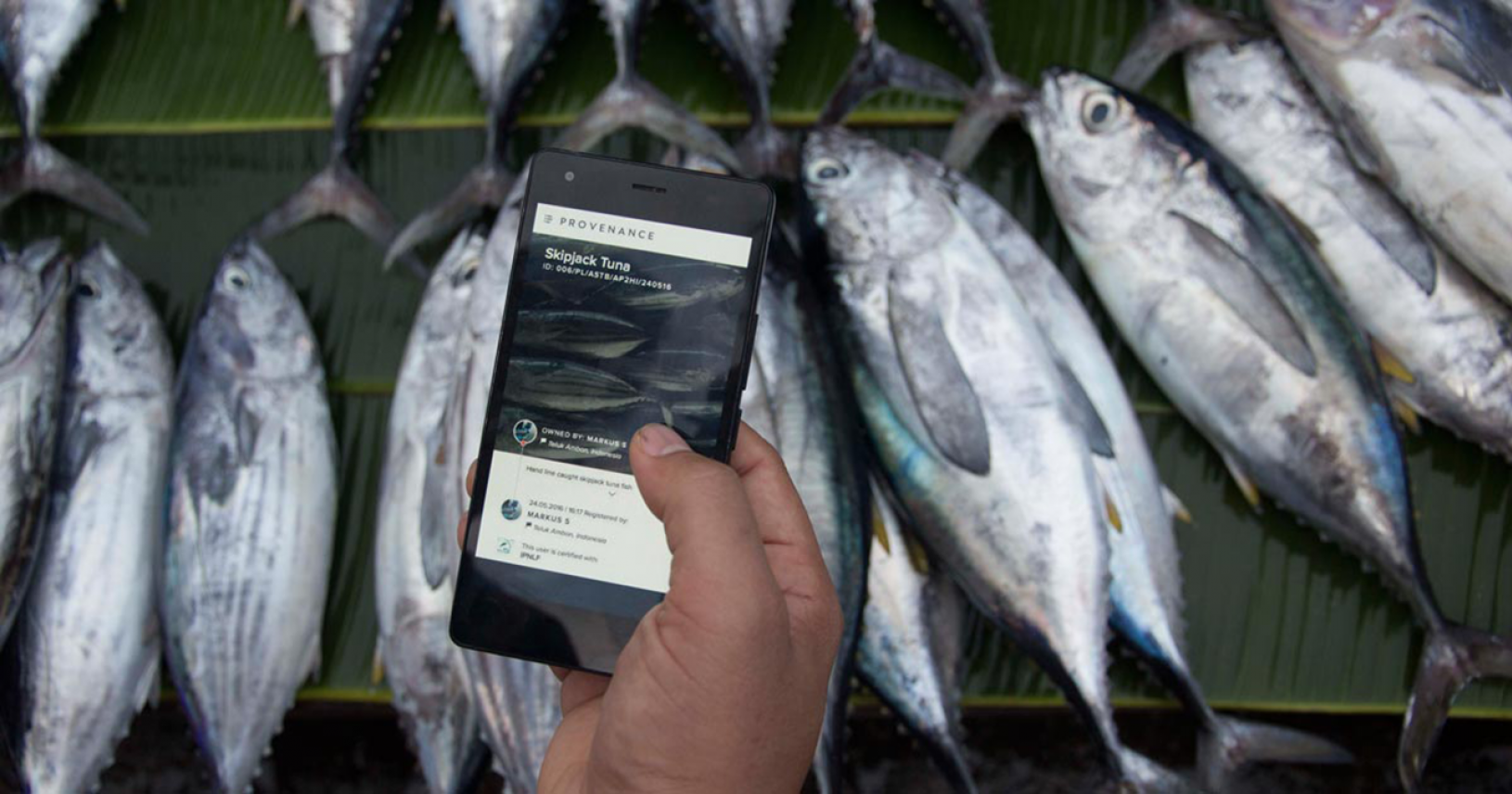

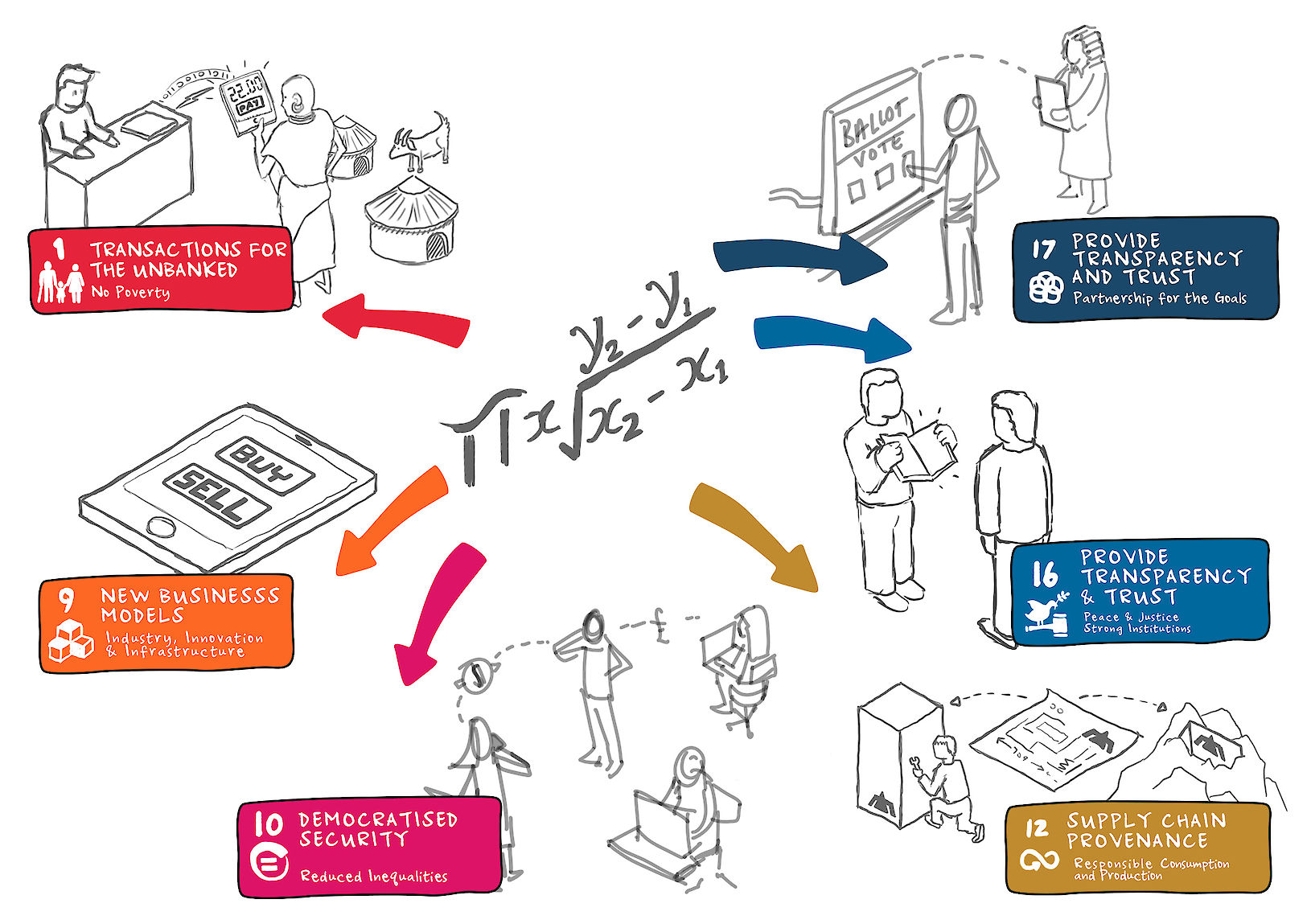

Currently the most common blockchain applications are cryptocurrencies. But blockchain offers a trusted, tamper-proof way of recording transactions for any digital asset. It could transform property and land rights, medical records, intellectual property, identity, and validation of provenance and ownership of goods and assets.

The barriers

Like all immature technology, blockchain still needs further development to deliver on its promise. In particular, given its potential to provide secure and tamper-proof records, the security of the associated applications and infrastructure will be critical. The regulatory and legal framework will also need to evolve to reflect the issues raised by blockchain.